Finance

The ERP finance module is the software component that handles the main accounting and financial management functions of an enterprise resource planning system. It contains standard accounting records, such as the general ledger (GL) and balance sheet; generates financial reports; and handles related transactions, such as invoicing and expense reporting. The ERP finance module, which is sometimes referred to as core finance, also commonly supports other financial management functions such as profitability analysis and revenue management.

Asset management

Managing fixed assets is one of the key things that is performed by the financial module. Here you have a register for the assets with all the transactions, solving fixed asset depreciation for the financial reports and asset revaluation. The key functions of the AM are investment and disposal, depreciation defined by the user methods, regular revaluations of the fixed assets, and insurance information

Vendor management

Vendor management as a function of an ERP finance module can help your organization manage end-to-end relationships with suppliers. This includes selecting and setting terms and conditions with vendors, monitoring their performance and compliance with your standards, and handling contract renewal or termination

Banking management

Through an integration with your company’s various bank accounts, an ERP finance module lets you view account balances and transactions, transfer funds, and reconcile transactions to create accurate financial statements.

Profit tracking

Tracking profitability is vital to monitoring and analysing any business's financial performance. A profit tracking system calculates your organisation's profits based on incurred costs and receivables. Profit forecasting programs use historical sales and expense data to predict future earnings.Integrating profit tracking with your ERP financials can help you better understand your business performance and the impact of any changes that you make

FutherMain Features

To try the most advanced business

Accounts payable (AP)

Accounts payable (AP) is a short-term debt and a liability on a balance sheet where a business owes money to its vendors/suppliers that have provided the business with goods or services on credit.

- Cash Payments

- Credit and Debit Notes

- Sales Service Journals

- Debit & Credit Note

- Purchase Journals

- Bill Wise Outstanding

Accounts receivable (AR)

Accounts receivable (AR) is an item in the general ledger (GL) that shows money owed to a business by customers who have purchased goods or services on credit. AR is the opposite of Accounts payable, which are the bills a company needs to pay for the goods and services it buys from a vendor

- Complete Integration with General Ledger

- Maintain Unlimited Number Of Customers

- Customer Receipts and Payments

- Sales & Service Journals

- Debit and Credit Note

- Ageing Analysis

General Ledger

A general ledger is a record of all of a company's, and its subsidiaries', assets, liabilities, expenses, income and equities. General ledgers are generally broken down into records of accounts and account balances and financial transactions and from there, if necessary, into subledgers.

- Cash Receipt and Payments

- Bank Deposits and Payments

- General Journal/Contra

- Credit/Debit Notes

Cash Management & Forecasting

Proactively managing cash flow enables organizations to make more informed decisions, mitigate risk, and optimize cash investments. Generally, cash forecasting is concerned with identifying liquidity requirements for the next 30 days, 60 days, or 90 days.

- Track cash inflows and outflows

- Maintain cash reserves

- Manage the accounts receivable

Bank Transaction & Reconciliations

A bank reconciliation statement summarizes banking and business activity, comparing the bank's account balance with internal financial records. Bank reconciliation statements confirm that payments have been processed and cash collections have been deposited into a bank account.

- Transaction capture

- Transaction verification

- Transaction posting

- Transaction reporting

Fixed asset management

Companies use this feature to track and manage tangible assets, such as computers, factory equipment and vehicles. Fixed asset management lets an organization take into consideration depreciation calculations, compliance requirements and tax implications. By using this feature, it can get better visibility into how it uses its fixed assets, along with their associated costs and maintenance.

Purchasing

Most ERP finance modules have features a company can use for basic purchasing of supplies and services, including generating the required paperwork, such as requisitions and purchase orders. Integration with AP usually provides the necessary handling of invoices, while invoice matching ensures that vendor invoices match the information in AP before payment is processed. Organizations that need more sophisticated purchasing capabilities, especially for buying the raw materials and components needed for manufacturing, usually have a more sophisticated procurement module from the ERP vendor or a third-party provider.

Risk and Compliance

Managing the risk of borrowers defaulting on loans or credit obligations. Managing the risk of losses due to changes in market conditions, such as interest rates or stock prices. Managing the risk of losses due to inadequate or failed internal processes, systems, or human error .Managing the risk of being unable to meet financial obligations due to insufficient liquidity. Adhering to laws, regulations, and standards set by government agencies, such as the SEC, FINRA, or OCC. Verifying customer identities and monitoring transactions to prevent financial crimes .

Tax Strategies

Delaying tax payments to a later year, such as through retirement accounts or deferred compensation plans. Claiming allowable expenses to reduce taxable income, such as charitable donations or mortgage interest. Claiming credits that directly reduce tax liability, such as the Earned Income Tax Credit (EITC) or Child Tax Credit. Transferring income to lower-tax individuals or entities, such as through gifting or business structures. Choosing business entities that minimize tax liability, such as pass-through entities or corporations.

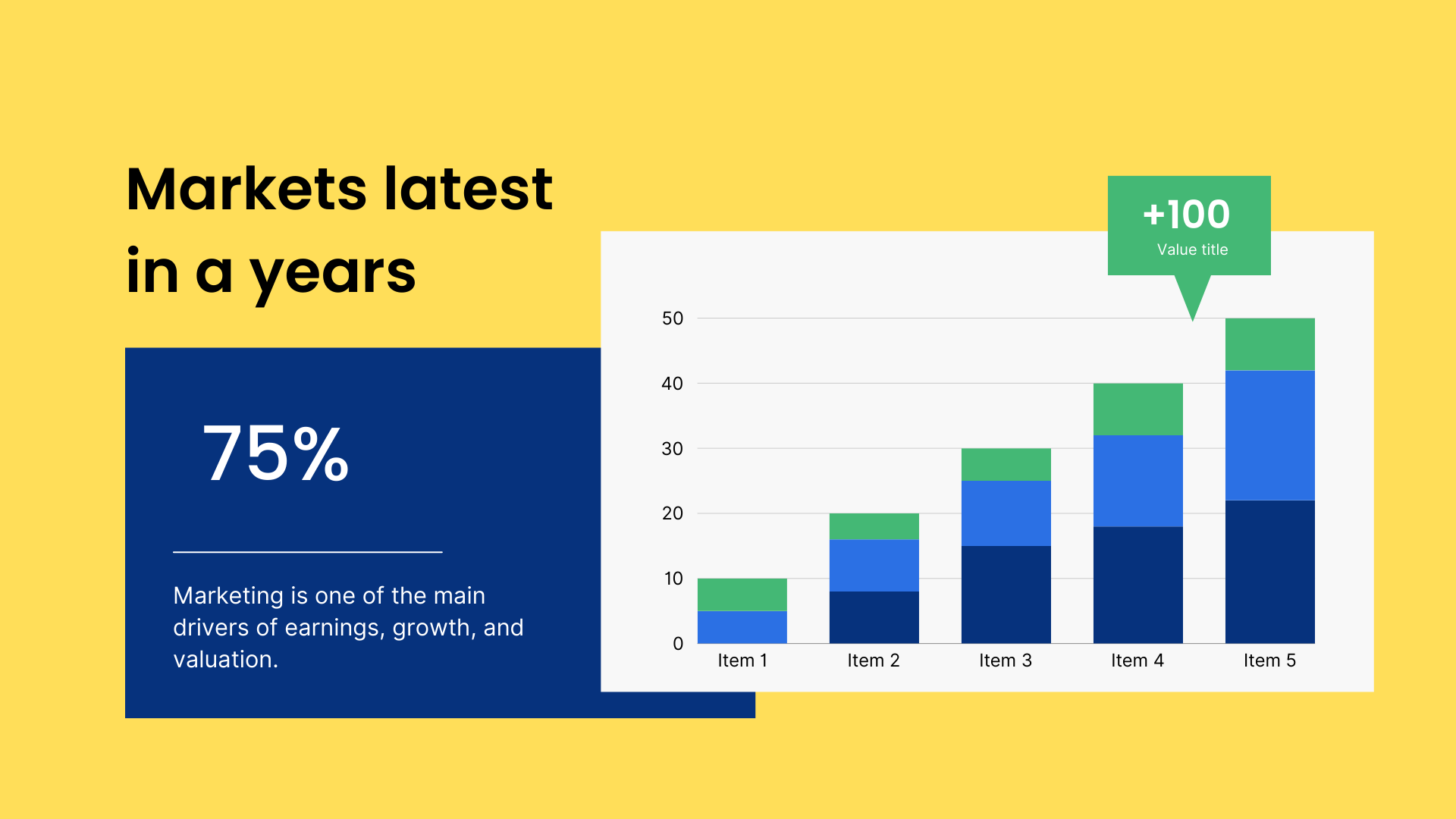

Financial analytics

You will see all the dashboards in real-time with receivables and payables data, various types of reports, and other important data units. Everything you see in finance modules in ERP is displayed in a user-friendly way with visuals. Analyzing historical data to forecast future financial performance. Creating reports to communicate financial results to stakeholders .Identifying and mitigating financial risks using data analysis. Analyzing investment portfolios to optimize returns and minimize risk.

Reporting

ERP software collects and processes information. If a system is developed correctly, it will display only accurate data. It’s good to have a solution that provides you with real-time data that is visually attractive. Here we mean charts, diagrams, and so on

- Income Statement ,Balance Sheet, Cash Flow Statement.

- Tax Returns, Regulatory Filings.

Greater productivity

The ability to automate manual processes that can be slow and error-prone, such as invoicing, speeds up the entire finance function, allowing businesses to close the books faster and finalize crucial financial reports sooner. This gives finance teams more time to focus on analysis, scenario modeling, and other high-value work.

- Automate Routine Tasks.

- Financial Software.

- Process Mapping.

- Standardize Procedures.

- Predictive Analytics.

Our Great Team

Sankar

Founder

Mohamed

Marketing

Divya

Designer

Sekar

Development Lead

Deepthi

HR Management

Vinoth

Sales HeadBuild Team Success

Our team of experts is dedicated to delivering innovative IT solutions that drive business success. With years of experience in software development, project management, and technical expertise, our team members are passionate about leveraging technology to solve real-world problems.

Support System

Our leaders inspire and motivate

Our developers create and innovate

Our project managers guide and support

Our quality assurance specialists ensure perfection

Our support specialists care and serve

Over 30.000 Customers

and let's see what are they saying

Lorem ipsum dolor sit amet consectetuer adipiscing elit euismod tincidunt ut laoreet dolore magna aliquam dolor sit amet consectetuer elit

Mark Nilson

DirectorLorem ipsum dolor sit amet consectetuer adipiscing elit euismod tincidunt aliquam dolor sit amet consectetuer elit

Lisa Wong

ArtistLorem ipsum dolor sit amet consectetuer elit euismod tincidunt aliquam dolor sit amet elit

Nick Dalton

DeveloperFusce mattis vestibulum felis, vel semper mi interdum quis. Vestibulum ligula turpis, aliquam a molestie quis, gravida eu libero.

Alex Janmaat

Co-FounderVestibulum sodales imperdiet euismod.

Jeffrey Veen

DesignerPraesent sed sollicitudin mauris. Praesent eu metus laoreet, sodales orci nec, rutrum dui.

Inna Rose

GoogleSed ornare enim ligula, id imperdiet urna laoreet eu. Praesent eu metus laoreet, sodales orci nec, rutrum dui.

Jacob Nelson

SupportAdipiscing elit euismod tincidunt ut laoreet dolore magna aliquam dolor sit amet consectetuer elit

John Doe

MarketingNam euismod fringilla turpis vitae tincidunt, adipiscing elit euismod tincidunt aliquam dolor sit amet consectetuer elit

Michael Stawson

Graphic DesignerQuisque eget mi non enim efficitur fermentum id at purus.

Liam Nelsson

ActorInteger et ante dictum, hendrerit metus eget, ornare massa.

Madison Klarsson

DirectorVestibulum sodales imperdiet euismod.

Ava Veen

WriterUt sit amet nisl nec dui lobortis gravida ut et neque. Praesent eu metus laoreet, sodales orci nec, rutrum dui.

Sophia Williams

AppleNam non vulputate orci. Duis sed mi nec ligula tristique semper vitae pretium nisi. Pellentesque nec enim vel magna pulvinar vulputate.

Melissa Korn

ReporterProduct Portfolio

Our Work

Payables

A payable is created any time money is owed by a firm for services rendered or products provided that have not yet been paid for by the firm. This can be from a purchase from a vendor on credit, or a subscription or installment payment that is due after goods or services have been received Amounts owed to suppliers for goods or services purchased.The Amounts owed for expenses incurred but not yet invoiced to creditors in the form of promissory notes and the amounts owed to government authorities for taxes.

Read More

Our Plan

To try the most advanced business

- System Storage Auditing

- Customized Reports

- Unlimited Training

- Data Migration and Developer Support

- 24X7 Online Support

- Direct Customer Visit for Customer Support

- Regular and Weekly Back up

- System Storage Auditing

- Customized Reports

- Unlimited Training

- Data Migration and Developer Support

- 24X7 Online Support

- Direct Customer Visit for Customer Support

- Regular and Weekly Back up

- System Storage Auditing

- Customized Reports

- Unlimited Training

- Data Migration and Developer Support

- 24X7 Online Support

- Direct Customer Visit for Customer Support

- Regular and Weekly Back up

Book A Demo

Contact Form

Kindly describe your request in details, and provide us your phone number to contact you back.